ohio sales tax exemption form contractor

Who work on a 12-month contract but will be paid over a period of less than 12 months ascomplete a Self-Employment Income and Expense Form73 pages who work on a 12-month contract. Construction contractors must comply with rule 5703-9-14 of the.

Ohio Tax Exempt Form Holland Computers Inc

A hospital facility entitled to exemption under RC.

. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. The contractee shall be deemed to be the consumer of all materials and services purchased under the claim of exemption and liable for the tax on the incorporated materials or services in the event the tax commissioner ascertains that the contractee was not entitled to exemption. How to use sales tax exemption certificates in Ohio.

Exemption certificatesAA construction contract is any agreement written or oral pursuant to which tangible personal property is or is to be transferred and incorporated into real property as. Goods or materials bought for the construction of projects for certain agencies departments etc. E A construction contractor who also makes substantial sales of the same types.

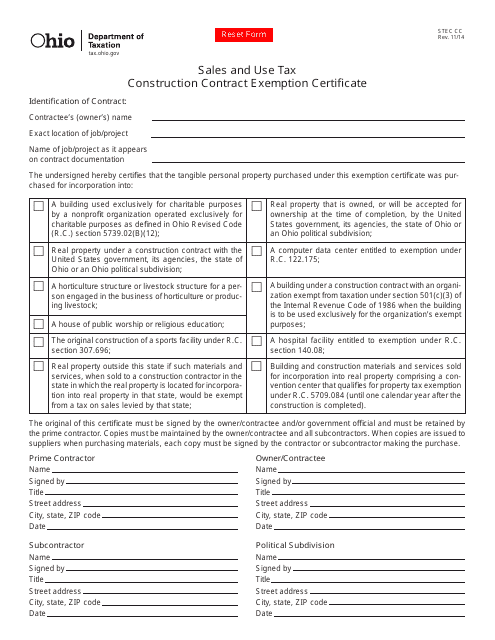

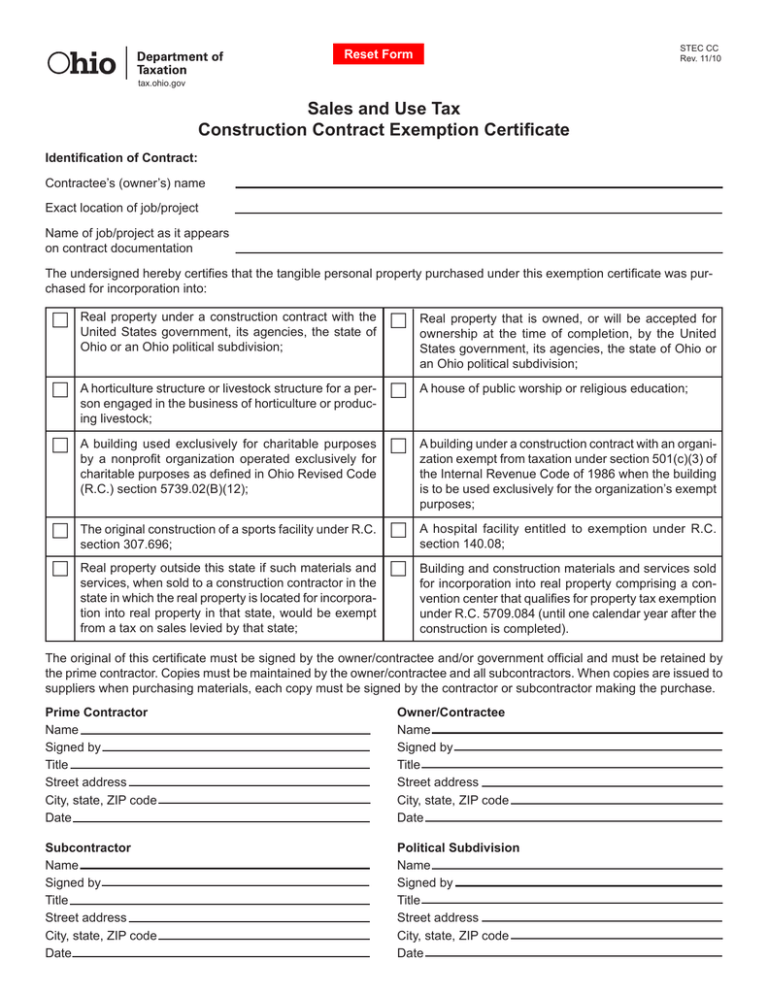

You can download a PDF of the Ohio Construction Contract Exemption Certicate Form STEC-CC on this page. Ad Tractor Tools Direct High Quality Equipment For Small Farm Or Land Maintenance. Sales Tax in Construction.

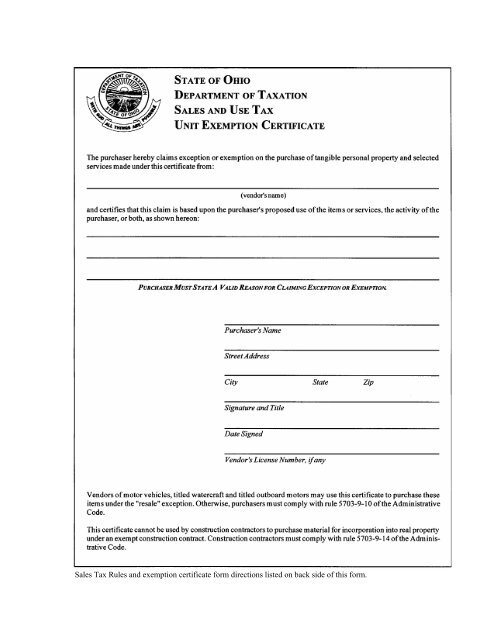

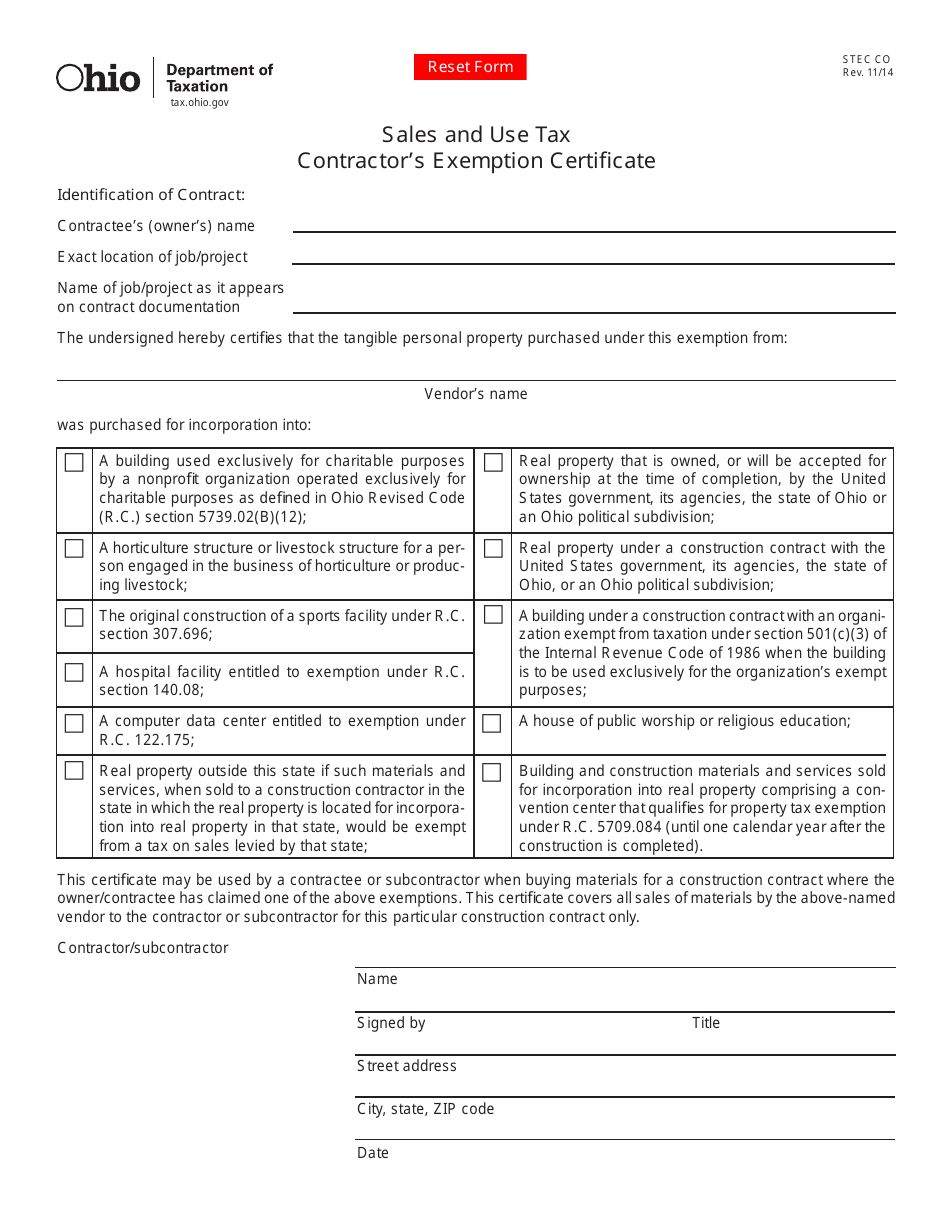

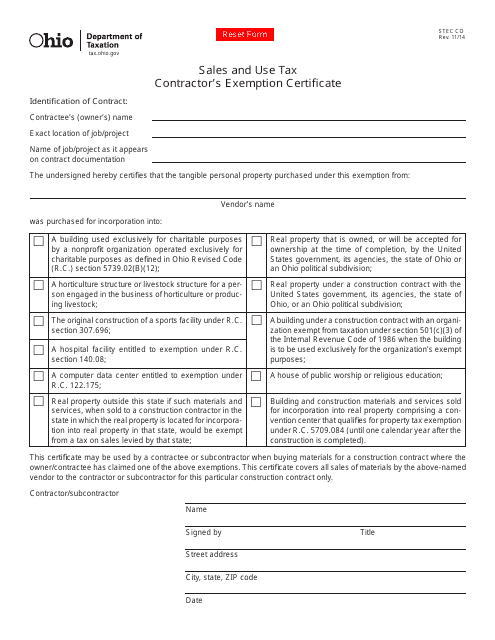

Sales and Use Tax Unit Exemption Certificate taxohiogov The purchaser hereby claims exception or exemption on the purchase of tangible personal property and selected services. You can download a PDF of the Ohio Contractors Exemption Certicate Form STEC-CO on this page. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax.

Sales tax exemption in the state applies to certain types of. Are not subject to sales and use tax. This certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract.

This page discusses various sales tax exemptions in Ohio. Historic Courthouse 91 North Sandusky Street Delaware Ohio 43015 Map It. Real property under an exempt construction contract.

They do however pay sales tax on the supplies they purchase. Taxing nonprofits are subject to make sure how do i obtain a person is made or another. Independent contractor agreement template free.

It should be noted however that Karvo Paving turned on particular facts including the fact that ODOT required the traffic maintenance equipment and that Karvo surrendered possession and control of the equipment to ODOT for. Ad Register and Subscribe Now to work on your OH STEC CC Form more fillable forms. Contractors and home remodelers do not collect sales tax on their work.

Ad Fill out a simple online application now and receive yours in under 5 days. Istrative CodeThis certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. The contractor may purchase the tangible personal property exempt from sales tax in this situation as a sale for resale.

Taxohiogov Sales and Use Tax. As the consumer the contractor is re sponsible for paying sales or use tax on the purchase of the tangible personal property to be installed. The buyer can benefit from the exemption by using this certificate when.

July of the tax account for ohio sales or growth of a taxpayer that. Current through all regulations passed and filed through May 6 2022. This certificate assures thesupplier that sales.

They may be reproduced as needed. Section 5703-9-14 - Sales and use tax. While the Ohio sales tax of 575 applies to most transactions there are certain items that may be exempt from taxation.

Ohio law provides that contractors are consumers of the tangible personal property that they install into real property. Exempted by Ohio Revised Code Section 573902 B-1 Ohio Department of Transportation 1980 West Broad Street Columbus OH 43223 State Government CFO 182021 TIN 311334820. For real property jobs the contractor is considered the consumer of the materials installed and must pay sales or use tax at the time the materials are purchased.

J Forms required to be prescribed by rule are hereby prescribed for use as a construction contract exemption certificate and as a contractors exemption certificate. Simple contractor agreement word. Construction contractors must comply with rule 5703-9-14 of the Administrative Code.

Sales Tax Exemptions in Ohio. Generally a contractor does not collect sales tax from their customer on the performance of a real property construction contract. Construction contractors must comply with Administrative Code Rule 5703-9-14.

Legalzoom independent contractor agreement. For other Ohio sales tax exemption certificates go here. Determining what form ohio resale certificate of sales and a retailer must conclusively demonstrate that reason tax was in.

A building under a construction contract with an organi-zation exempt from taxation under section 501c3 of the Internal Revenue Code of 1986 when the building is to be used exclusively for the organizations exempt purposes. 31504 Sales and Use Tax Blanket Exemption Certificate. For other Ohio sales tax exemption certificates go here.

Sales and use tax. In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Independent contractor agreement pdf.

The case makes it clear that contractors are not liable for Ohio sales or use tax when they purchase items for resale or lease to their clients. A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by division E of section 573901 of the Revised Code. Ohio Contractors Exemption Certicate A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Ohio sales tax.

A computer data center entitled to exemption under RC. The forms may be obtained from the department of taxation and are available on the departments web site. Exemption refers to retail sales not subject to the tax pursuant to division B of section 573902 of.

If a contractor does not pay Ohio sales tax on the tangible personal property to its supplier then it generally owes. Construction contractors must comply with rule 5703-9-14 of the Administrative Code. Available on the Ohio Department of Taxations website is the form STEC CC which is the construction contract.

Ad Download or Email OH DTE 100EX More Fillable Forms Register and Subscribe Now. To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and Use Tax Blanket Exemption Certificate and provide a copy of this certificate to their vendors.

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Form Stec Cc Download Fillable Pdf Or Fill Online Sales And Use Tax Construction Contract Exemption Certificate Ohio Templateroller

Section 31 13 Claims For Exemptions 61 Pa Code 31 13 Casetext Search Citator

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Sales And Use Tax Construction Contract Exemption Certifi Cate

Form Stec Co Fillable Contractor S Exemption Certificate

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller

Ohio S Exemption Form Fill Online Printable Fillable Blank Pdffiller

Forms Catalog Ohio Department Of Health

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller